January 2022 suggests that in the new year, a new strategy must be implemented in order to buy a home.

While traditionally the market sees a 70 percent increase in new listings from December to January, the market ended down 17.77 percent in new listings compared to 2021, a 31.04 increase from the previous month. Likewise, the market ended with month-end active listings at a historic low of 1,184. To put into context, that is over 10 times less inventory than normal.

Last year at this time, there was little inventory. This year, there’s nearly half as much at 48.88 percent less, which will likely translate to fewer homes being bought and sold over the course of the year as there is less to choose from in the Denver Metro area prompting the continuation of extreme bidding wars.

“Prices dropped slightly, both average and median, but that is not reflective of our current market but rather 90 days ago,” commented Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “Based on the historic low inventory and current market demand, prices will likely skyrocket in the next three months. With the low inventory and competition, we are expecting prices to greatly increase in the first half of this year. Creativity in writing offers has been instrumental for a successful outcome. While many buyers grow frustrated through the process, leading to potential burnout, I want to emphasize that there are still diamonds in the rough.”

With historically low inventory, hyperactive demand and some outlining stories, the major question is what buyers and sellers can do to prepare in this unprecedented market? If someone is a buyer, it is imperative to do one’s due diligence before touring a property, as well as communicating with one’s Realtor® and lender to understand what one’s comfort level is, which may vary from what someone has been originally approved. In this market, creating a list of “must-haves” and “deal-breakers” can help to direct your decision-making even more.

Luxury Market Report

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $300,000 and $499,999).

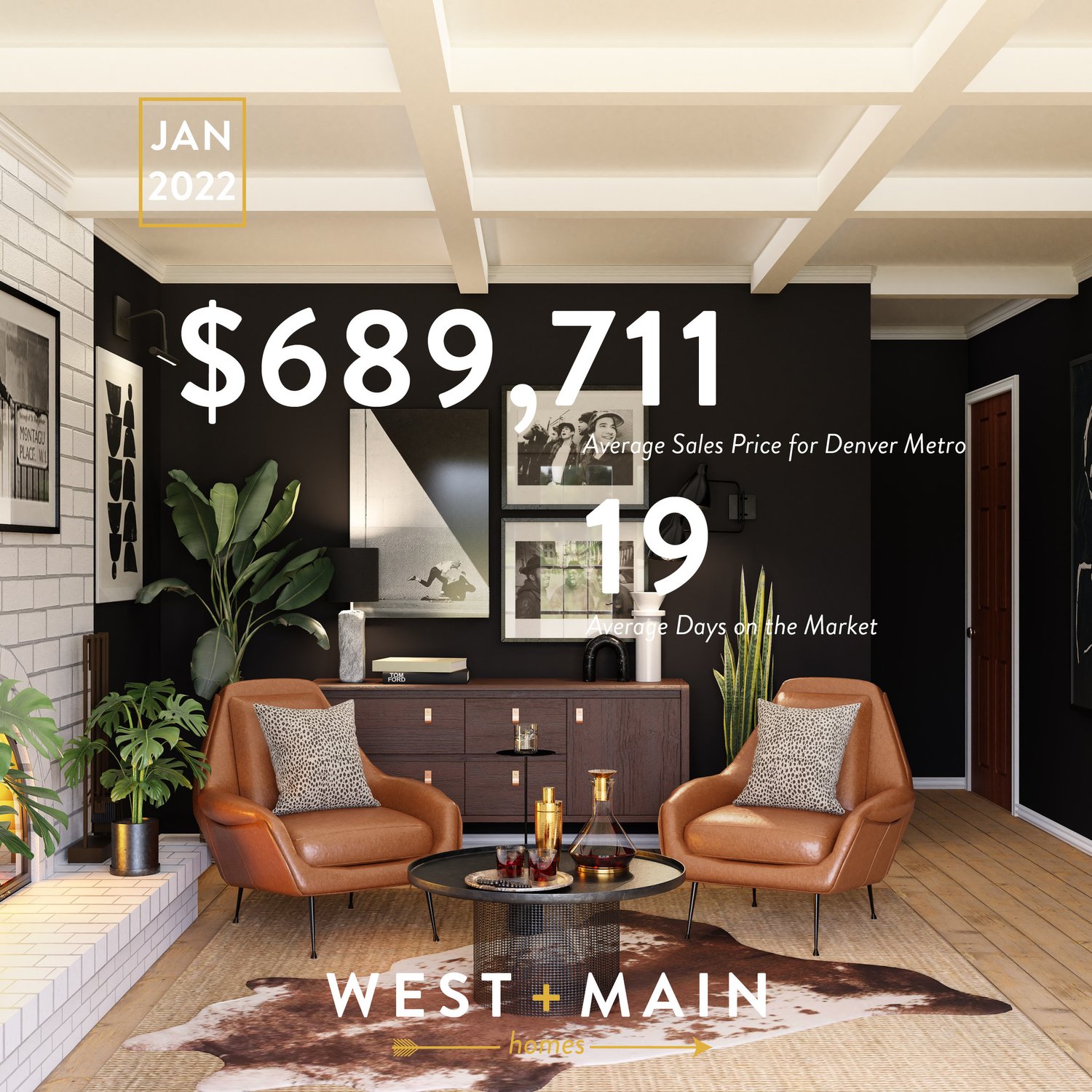

In the Luxury Market, the question buyers and brokers are asking lately is whether $1 million is really considered luxury at this point in time? The average sales price for the Luxury Market remains at $1.6 million, and it has been for many years. In 2014, when DMAR’s Market Trends Report was started, the average price for a single-family home was $380,848 and the average price for an attached property was $238,229. Today, the average sales price in Denver for a single-family home is $689,711, and $450,244 for an attached home, and the average for the Signature Market is in the mid- $800,000’s.

Inventory for the January Luxury Market was up exactly 100 percent for detached luxury homes, and up 82.61 percent for luxury attached properties. It didn’t take long for all that inventory to get scooped up though, as 43.48 percent of the detached luxury homes and 19.35 of the attached luxury homes went under contract. While Denver Metro had more inventory, the sales volume was down for detached and attached segments.

The luxury detached sales volume was down 49.86 percent from the prior month and 11.78 percent from one year ago, as Denver saw 47.29 fewer luxury properties close from the prior month and 9.51 percent from this time last year. The attached luxury sales volume was down 48.23 percent and had 55.36 percent fewer luxury condos sold from the prior month and 13.79 percent from one year ago.

The luxury attached segments had the most inventory out of all the segments at 2.68 months while the median days in MLS was three, the average days in MLS increased 97.96 percent, giving buyers a little more time to make a decision. With several new construction condo building listings still in the market, this may give buyers a few more choices. While there is a bit more inventory in the attached luxury segment, sellers are still getting 101.99 percent close-price-to-list-price. This represents an increase of 0.68 percent from the prior month and 4.50 percent from one year ago.

“Now is the time to sell in the Luxury Market,” said Brigette Modglin, DMAR Market Trends Committee member and Metro Denver Realtor®. “Both the attached and detached homes are getting over 100 percent of asking price and you’re able to make your next move very quickly. The question is where will you make it?”